Buy Sony Hand Over Fist

In the past few months I have covered Nokia (NOK)

and by calculating the sum of its parts I came away with the conclusion

that it is very undervalued. Back in mid September I also wrote that

Nokia would outperform Apple (AAPL)

and in the time since then AAPL is down 21% while NOK is up 29%.

Apple's momentum has clearly slowed and it may be opening up people's

eyes to the other companies that have been left for dead over the past

several years.

Much in the same vein as Nokia, shares of Research in Motion (RIMM) are up about 90% over the past 4 months. It seems as though the trade that appears to be working is a reversion to the mean trade for the consumer electronics companies that have been left for dead in the wake of the unstoppable Apple machine.

So which company could be next? There are plenty of candidates, but one that comes to mind is Sony (SNE).

Sony is a massive company and for that reason alone I'm going to split up my focus on it in a couple of parts. Here is part one, which is mainly an overview of its business as well as a look at one key catalyst to get the stock moving. As we're all aware, most stocks tend to move before any real fundamental changes occur within the business. Perhaps it is a lack of sellers or short covering or perhaps people sense that change is occurring within the company. Sometimes it is an outside event that proves to be a catalyst: a regulatory change or a new method of doing business. In Sony's case I believe the falling Yen can provide to be an initial spark that could trigger an end to the downward spiral in the stock.

About Sony:

Sony has a variety of businesses that it operates in but under new CEO Kazuo Harai, who rose through the ranks at CBS/Sony (now Sony Music Entertainment) and Sony Computer Entertainment and became CEO effective April 2012, the focus of its business will be on strengthening three key areas:

(1) Digital Imaging

(2) Gaming

(3) Mobile

Its focus will also be on turning around the TV business, which lost tremendous market share to Samsung (SSNLF.PK), and focusing on expanding its presence in the medical field, amongst other things. It appears that they see the writing on the wall with consumer electronics devices (i.e., far too much competition) and have shifted its focus more on technologies within the medical and digital imaging industries.

Another area of focus for Sony is its motion pictures business, Sony Pictures Entertainment, Inc. In 2012 SPE had a 16.6% market share, which was #1 in the industry and it generated $8.1 billion in revenues. By comparison, Lionsgate (LGF), which is a $2.2 billion company, had a 7.3% market share. Doing some simple arithmetic, one could argue that the movie business alone is worth roughly $5 billion on the open market (assumes a ratio of 2.4 to 1 when comparing market shares of Sony to LGF).

Sony's entire company generates roughly $80 billion in revenues, so the market is suggesting that the other $72 billion in revenues is worth only $6 billion. That is a price to sales ratio of 0.08. By comparison, let's take a look at some other beaten down electronics companies:

Hewlett-Packard (HPQ) - 0.25

Dell (DELL) - 0.31

Nokia - 0.38

Research in Motion - 0.54

I would love to hear someone justify why a global powerhouse like SNE trades at such a huge discount to all of these businesses, which are all having significant issues of its own. What is the justification for SNE to trade at a discount of 66% to 85% to these dogs?

So what is the catalyst to get people to buy Sony?

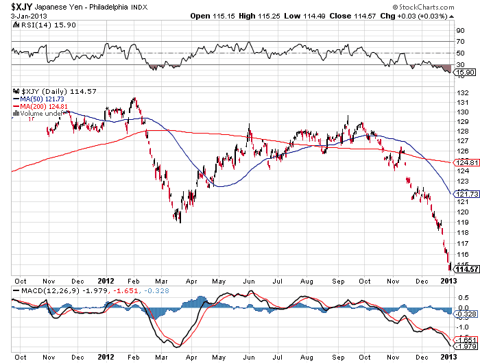

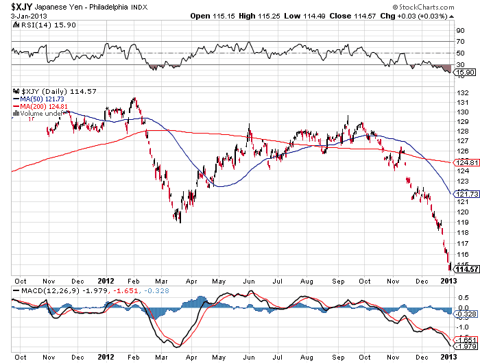

This one is easy. Take a look at the chart of the Yen:

(click to enlarge)

In the backdrop of the Fiscal Cliff nonsense, the Yen has completely fallen out of bed and investors in the U.S. have completely ignored it. Almost no media outlet has covered this move and the ramification it will have on Japanese companies like Sony, Panasonic (PC) and Toyota (TM), amongst others. It is my contention that the 40-year bull market in the Yen is over and that there is a chance we will see a very sharp drop in the Yen. This will have profound positive impacts on the Nikkei (EWJ) and Japanese stocks.

Japan has been on an unsustainable path of deflation and a strong currency. Japan's exporters have been getting crushed for years as the government has only done half-hearted attempts to combat deflation through monetary stimulus.

Recently much has been made about Shinzo Abe's return to power as Japan's prime minister. Abe has been quoted as wanting to target 2% inflation and he is pressuring the central bank of Japan to work more closely with the government to achieve this target. The writing is on the wall: he wants to print Yen.

Japan's nominal GDP contracted 8 percent from Q3 2007 to Q3 2011 of which 6% of that was due to deflation. This is the worst deflation that Japan has seen since the Great Depression. Japan's nominal GDP and nominal wages peaked in 1997 and the U.S. Dollar to Yen ratio had dropped from 360 to 75 between 1971 and 2011. Property prices have dropped every year since 1997 and the Nikkei has had only a handful of positive years over the last 15 years.

The issue is everyone has been brainwashed into believing in the Strong Yen. Japan's culture is very group-oriented and one only has to look at the boom in real estate prices in the 1980's and the boom in the Yen over the past 4 decades as proof.

The real estate bubble in Japan in the late 1980's is thought to have been 5 times larger than the bubble seen in the U.S. in the 2000's. Likewise, the bubble in the Yen is just as large.

Yen bulls have held to the notion that Japan's trade and current account surplus supports the Yen. A current account surplus occurs when savings are greater than investment. When a country's investment levels drop, then competitiveness should naturally decline. This has been the case for the Japanese economy for the past 15 years. Japan's competitiveness in the auto industry and the electronics industry, two pillars of the Japanese economy, has dwindled.

A currency bull market whose foundation is built upon a weak economy is extremely suspect. However, the Yen bull market has lasted so long that even foreigners are taking it for granted. For years people had been calling a top in the Yen's rise; however, now it is hard to find a Yen bear out there. Most people only recall a strong Yen… they have no idea what it is like to have a weak Yen. The group-oriented culture within Japan buys Yens because real estate and stocks continue to go down. Hardly anyone even remembers a time when those two markets went up. The strong Yen is now a cult.

All of this appears to be changing fast. The Yen is completely free-falling, thanks in part to what I believe is a collective awareness within Japan that the only way out is to print Yens like crazy and to possibly even resort to a devaluation on a massive scale. Japanese companies have been badly hurt by the rising Yen and the impact on Japan's psychology has been immense.

The recent fall in the Yen; however, is offering up a huge boost for the export-dependent economy. Prices of goods coming out of Japan are falling significantly enough to now have an impact on domestic exporters. A weaker Yen enables Japan's exporters to gain market share or to boost margins. "A significant chunk of Japanese companies' overall profits also comes from its foreign operations - if the Yen weakens, overseas profits are worth more in Japanese currency," said Capital Economics markets analyst John Higgins.

I believe Sony should be bought hand over fist. Not only does it have a massive positive catalyst in a falling Yen, but its valuation has gotten completely out of whack. Excluding the movie business, Sony trades at a price to sales of 0.08. By comparison HPQ, DELL, NOK, and RIMM trade at 3 to 7 times higher valuations than the remaining portion of Sony's business. That is one of the more irrational valuations I have seen over the years.

Much in the same vein as Nokia, shares of Research in Motion (RIMM) are up about 90% over the past 4 months. It seems as though the trade that appears to be working is a reversion to the mean trade for the consumer electronics companies that have been left for dead in the wake of the unstoppable Apple machine.

So which company could be next? There are plenty of candidates, but one that comes to mind is Sony (SNE).

Sony is a massive company and for that reason alone I'm going to split up my focus on it in a couple of parts. Here is part one, which is mainly an overview of its business as well as a look at one key catalyst to get the stock moving. As we're all aware, most stocks tend to move before any real fundamental changes occur within the business. Perhaps it is a lack of sellers or short covering or perhaps people sense that change is occurring within the company. Sometimes it is an outside event that proves to be a catalyst: a regulatory change or a new method of doing business. In Sony's case I believe the falling Yen can provide to be an initial spark that could trigger an end to the downward spiral in the stock.

About Sony:

Sony has a variety of businesses that it operates in but under new CEO Kazuo Harai, who rose through the ranks at CBS/Sony (now Sony Music Entertainment) and Sony Computer Entertainment and became CEO effective April 2012, the focus of its business will be on strengthening three key areas:

(1) Digital Imaging

(2) Gaming

(3) Mobile

Its focus will also be on turning around the TV business, which lost tremendous market share to Samsung (SSNLF.PK), and focusing on expanding its presence in the medical field, amongst other things. It appears that they see the writing on the wall with consumer electronics devices (i.e., far too much competition) and have shifted its focus more on technologies within the medical and digital imaging industries.

Another area of focus for Sony is its motion pictures business, Sony Pictures Entertainment, Inc. In 2012 SPE had a 16.6% market share, which was #1 in the industry and it generated $8.1 billion in revenues. By comparison, Lionsgate (LGF), which is a $2.2 billion company, had a 7.3% market share. Doing some simple arithmetic, one could argue that the movie business alone is worth roughly $5 billion on the open market (assumes a ratio of 2.4 to 1 when comparing market shares of Sony to LGF).

Sony's entire company generates roughly $80 billion in revenues, so the market is suggesting that the other $72 billion in revenues is worth only $6 billion. That is a price to sales ratio of 0.08. By comparison, let's take a look at some other beaten down electronics companies:

Hewlett-Packard (HPQ) - 0.25

Dell (DELL) - 0.31

Nokia - 0.38

Research in Motion - 0.54

I would love to hear someone justify why a global powerhouse like SNE trades at such a huge discount to all of these businesses, which are all having significant issues of its own. What is the justification for SNE to trade at a discount of 66% to 85% to these dogs?

So what is the catalyst to get people to buy Sony?

This one is easy. Take a look at the chart of the Yen:

(click to enlarge)

In the backdrop of the Fiscal Cliff nonsense, the Yen has completely fallen out of bed and investors in the U.S. have completely ignored it. Almost no media outlet has covered this move and the ramification it will have on Japanese companies like Sony, Panasonic (PC) and Toyota (TM), amongst others. It is my contention that the 40-year bull market in the Yen is over and that there is a chance we will see a very sharp drop in the Yen. This will have profound positive impacts on the Nikkei (EWJ) and Japanese stocks.

Japan has been on an unsustainable path of deflation and a strong currency. Japan's exporters have been getting crushed for years as the government has only done half-hearted attempts to combat deflation through monetary stimulus.

Recently much has been made about Shinzo Abe's return to power as Japan's prime minister. Abe has been quoted as wanting to target 2% inflation and he is pressuring the central bank of Japan to work more closely with the government to achieve this target. The writing is on the wall: he wants to print Yen.

Japan's nominal GDP contracted 8 percent from Q3 2007 to Q3 2011 of which 6% of that was due to deflation. This is the worst deflation that Japan has seen since the Great Depression. Japan's nominal GDP and nominal wages peaked in 1997 and the U.S. Dollar to Yen ratio had dropped from 360 to 75 between 1971 and 2011. Property prices have dropped every year since 1997 and the Nikkei has had only a handful of positive years over the last 15 years.

The issue is everyone has been brainwashed into believing in the Strong Yen. Japan's culture is very group-oriented and one only has to look at the boom in real estate prices in the 1980's and the boom in the Yen over the past 4 decades as proof.

The real estate bubble in Japan in the late 1980's is thought to have been 5 times larger than the bubble seen in the U.S. in the 2000's. Likewise, the bubble in the Yen is just as large.

Yen bulls have held to the notion that Japan's trade and current account surplus supports the Yen. A current account surplus occurs when savings are greater than investment. When a country's investment levels drop, then competitiveness should naturally decline. This has been the case for the Japanese economy for the past 15 years. Japan's competitiveness in the auto industry and the electronics industry, two pillars of the Japanese economy, has dwindled.

A currency bull market whose foundation is built upon a weak economy is extremely suspect. However, the Yen bull market has lasted so long that even foreigners are taking it for granted. For years people had been calling a top in the Yen's rise; however, now it is hard to find a Yen bear out there. Most people only recall a strong Yen… they have no idea what it is like to have a weak Yen. The group-oriented culture within Japan buys Yens because real estate and stocks continue to go down. Hardly anyone even remembers a time when those two markets went up. The strong Yen is now a cult.

All of this appears to be changing fast. The Yen is completely free-falling, thanks in part to what I believe is a collective awareness within Japan that the only way out is to print Yens like crazy and to possibly even resort to a devaluation on a massive scale. Japanese companies have been badly hurt by the rising Yen and the impact on Japan's psychology has been immense.

The recent fall in the Yen; however, is offering up a huge boost for the export-dependent economy. Prices of goods coming out of Japan are falling significantly enough to now have an impact on domestic exporters. A weaker Yen enables Japan's exporters to gain market share or to boost margins. "A significant chunk of Japanese companies' overall profits also comes from its foreign operations - if the Yen weakens, overseas profits are worth more in Japanese currency," said Capital Economics markets analyst John Higgins.

I believe Sony should be bought hand over fist. Not only does it have a massive positive catalyst in a falling Yen, but its valuation has gotten completely out of whack. Excluding the movie business, Sony trades at a price to sales of 0.08. By comparison HPQ, DELL, NOK, and RIMM trade at 3 to 7 times higher valuations than the remaining portion of Sony's business. That is one of the more irrational valuations I have seen over the years.

No comments:

Post a Comment