Will Amazon Drop 30% Like Apple?

Despite many fundamental differences between Amazon (AMZN_) and Apple (AAPL_), they do share one key fundamental metric and an important technical similarity that may leave you questioning how far Amazon shares may fall.

Both companies have very small short interest, and both became overbought based on my reading of the charts using DeMark Indicators. Let's take a look at the short interest of both companies.

The last reported level of short interest for Apple is dated Jan. 15. On that day the short interest was about 17.7 million shares, which may initially appear excessive but it works out to less than one day's average trading volume.

Relative to the trading float of about 940 million shares, the short interest is only about 1.9%. This is a very small amount and generally considered a good thing. I say generally because sometimes small short interest can result in fewer buyers when a stock price falls and needs buyers the most.

Short sellers wanting to lock in profits will buy back the shares they shorted, resulting in buying pressure that would not otherwise exist. Stocks often overshoot to the upside and downside, and lack of short interest exacerbates euphoric optimism and depressing fear.

Amazon also has a low level of short interest. The intuitive reaction is to view small short interest positively. If the smartest market participants are short sellers, and short sellers haven't made bets against the company, the prospects should look very favorable.

The problem that needs to be asked is, Why? Why are shorts avoiding Amazon? I believe short sellers are avoiding Amazon because they believe the price can remain irrational longer than they can stay solvent. In other words, Amazon isn't a great investment, but the herd mentality is something to take very seriously.

Apple could be considered overbought based on DeMark timing back in September, but has now gone full circle. I consider it oversold and a great value buy. Amazon, on the other hand, is now overbought and I believe the downside risk outweighs the upside potential.

Amazon's operating and profit margins are not trending in the typical

direction a high-flying stock usually occupies. Keep in mind that

Amazon is not experiencing a one-off event with low margins. The trend

started low and has moved even lower. Even after a strong holiday sales

quarter, Amazon is now losing money on a trailing 12-month basis.

AMZN Operating Margin TTM data by YCharts

AMZN Operating Margin TTM data by YCharts

The perma-bulls are quick to point out Amazon is a future growth story. I'm not sure the growth story holds water. The growth rate is slowing, too.

AMZN Revenue Quarterly YoY Growth data by YCharts

AMZN Revenue Quarterly YoY Growth data by YCharts

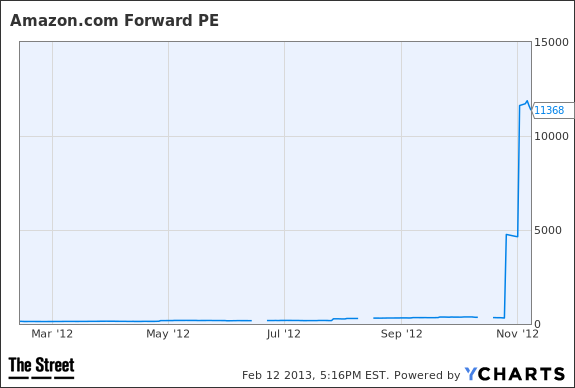

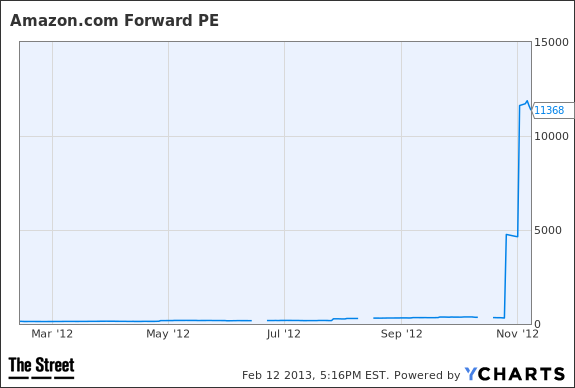

What about future profitability? This is where an investor leaves reality and enters a Twilight Zone state of mind to wrap your head around the numbers.

The future expected profitability of Amazon is so high that even the slightest speed bump is likely to upset the Apple cart and cause a mass exit of investor confidence. Take a look at a chart that may paint a discouraging picture as far as your portfolio is concerned.

AMZN Forward PE data by YCharts

AMZN Forward PE data by YCharts

I don't normally include this many charts, but Amazon is really the exception to the investing rule. Yes, I know The Street's Rocco Pendola says traditional valuations somehow don't apply to Amazon because Jeff Bezos is a super-human CEO.

Bezos is obviously the exception to the rule and has navigated many obstacles including the dot-com bubble bursting, but not because he turned Amazon into an earnings powerhouse. Bezos' genius has been his ability to convince investors to forego earnings quarter after quarter.

Unfortunately, as Amazon grows, the scale of operation requires greater market share from other retailers that may not sell at a competitive disadvantage. Wal-Mart (WMT_), Target (TGT_) and eBay (EBAY_) can each compete on a level playing field with Amazon.

Actually, eBay may be increasing its competitive landscape. eBay, unlike Amazon, doesn't directly own any warehouse space. eBay still is able to offer products with one- or two-day cheap delivery as a result of thousands of spare bedrooms, retail space and store overstock space holding inventory. Amazon's build-out of warehouse space, and the added payroll that goes with it, may permanently move Amazon into the breaking-even (or worse) column.

Wal-Mart and Target offer online sales and same- and/or next-day

delivery is easily offered through current retail stores. Unless Amazon

is planning on going mano a mono with larger, more powerful retailers, Wal-Mart, Target and Best Buy (BBY_)

can sell a product online, have the customer come to pick it up, and

maybe sell other products. Amazon isn't in a reported position to

conduct retail sales right now.

Bottom line, I believe Amazon is a sub-$200 stock within a year.

At the time of publication the author had no position in any of the stocks mentioned.

This article was written by an independent contributor, separate from TheStreet's regular news coverage.

AMZN Operating Margin TTM data by YCharts

AMZN Operating Margin TTM data by YChartsThe perma-bulls are quick to point out Amazon is a future growth story. I'm not sure the growth story holds water. The growth rate is slowing, too.

AMZN Revenue Quarterly YoY Growth data by YCharts

AMZN Revenue Quarterly YoY Growth data by YChartsWhat about future profitability? This is where an investor leaves reality and enters a Twilight Zone state of mind to wrap your head around the numbers.

The future expected profitability of Amazon is so high that even the slightest speed bump is likely to upset the Apple cart and cause a mass exit of investor confidence. Take a look at a chart that may paint a discouraging picture as far as your portfolio is concerned.

AMZN Forward PE data by YCharts

AMZN Forward PE data by YChartsI don't normally include this many charts, but Amazon is really the exception to the investing rule. Yes, I know The Street's Rocco Pendola says traditional valuations somehow don't apply to Amazon because Jeff Bezos is a super-human CEO.

Bezos is obviously the exception to the rule and has navigated many obstacles including the dot-com bubble bursting, but not because he turned Amazon into an earnings powerhouse. Bezos' genius has been his ability to convince investors to forego earnings quarter after quarter.

Unfortunately, as Amazon grows, the scale of operation requires greater market share from other retailers that may not sell at a competitive disadvantage. Wal-Mart (WMT_), Target (TGT_) and eBay (EBAY_) can each compete on a level playing field with Amazon.

Actually, eBay may be increasing its competitive landscape. eBay, unlike Amazon, doesn't directly own any warehouse space. eBay still is able to offer products with one- or two-day cheap delivery as a result of thousands of spare bedrooms, retail space and store overstock space holding inventory. Amazon's build-out of warehouse space, and the added payroll that goes with it, may permanently move Amazon into the breaking-even (or worse) column.

Bottom line, I believe Amazon is a sub-$200 stock within a year.

At the time of publication the author had no position in any of the stocks mentioned.

This article was written by an independent contributor, separate from TheStreet's regular news coverage.

No comments:

Post a Comment