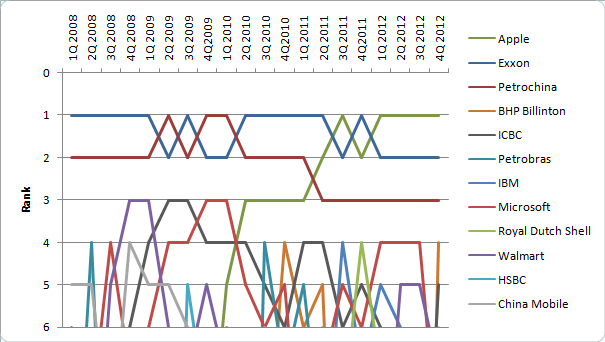

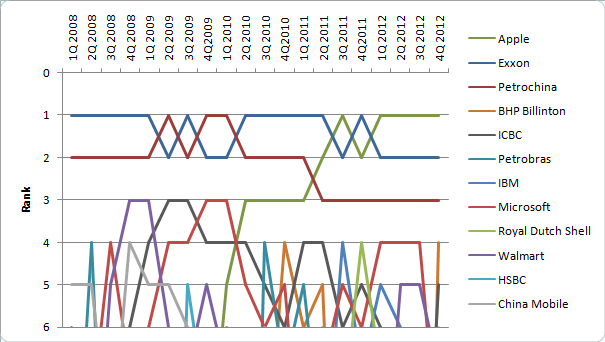

Graph of ranks of first five companies (2009-2011)

The following is a

list of publicly traded companies having the greatest market capitalization, as well as

government-owned corporations by estimated market value.

Market capitalization is calculated from the share price (as recorded

on selected day) multiplied by the number of shares issued. Figures are

converted into

USD millions (using rate from selected day) to allow for comparison.

Some

state-owned companies are far larger than even the largest public corporation. For example

Saudi Aramco's value is estimated from $781 billion

[1] to $7 trillion USD, more than a dozen times the size of any companies on this list making it the world's most valuable company.

[2]

Publicly traded companies

2012

This

Financial Times Global 500 based list is up to date as of December 31, 2012. Indicated changes in market value are relative to the previous quarter.

| Rank |

First quarter[3] |

Second quarter[4] |

Third quarter[5] |

Fourth quarter[6] |

| 1 |

|

Apple Inc.

559,002.1 559,002.1 |

|

Apple Inc.

546,076.1 546,076.1 |

|

Apple Inc.

625,348.1 625,348.1 |

|

Apple Inc.

500,610.7 500,610.7 |

| 2 |

|

Exxon Mobil

408,777.4 408,777.4 |

|

Exxon Mobil

400,139.1 400,139.1 |

|

Exxon Mobil

422,127.5 422,127.5 |

|

Exxon Mobil

394,610.9 394,610.9 |

| 3 |

|

PetroChina

278,968.4 278,968.4 |

|

PetroChina

257,685.8 257,685.8 |

|

PetroChina

253,853.3 253,853.3 |

|

PetroChina

264,833.4 264,833.4 |

| 4 |

|

Microsoft

270,644.1 270,644.1 |

|

Microsoft

256,982.4 256,982.4 |

|

Microsoft

249,489.8 249,489.8 |

|

BHP Billiton

247,409.0 247,409.0 |

| 5 |

|

IBM

241,754.6 241,754.6 |

|

Wal-Mart

235,900.3 235,900.3 |

|

Wal-Mart

248,074.4 248,074.4 |

|

ICBC

236,457.9 236,457.9 |

| 6 |

|

ICBC

236,335.4 236,335.4 |

|

IBM

225,598.5 225,598.5 |

|

General Electric

239,791.2 239,791.2 |

|

China Mobile

234,040.2 234,040.2 |

| 7 |

|

Royal Dutch Shell

222,425.1 222,425.1 |

|

General Electric

220,806.3 220,806.3 |

|

IBM

237,068.4 237,068.4 |

|

Wal-Mart

228,245.4 228,245.4 |

| 8 |

|

China Mobile

220,978.9 220,978.9 |

|

China Mobile

219,481.3 219,481.3 |

|

Chevron Corporation

228,707.1 228,707.1 |

|

Samsung Electronics

227,581.8 227,581.8 |

| 9 |

|

General Electric

212,317.7 212,317.7 |

|

Royal Dutch Shell

217,048.2 217,048.2 |

|

China Mobile

222,817.8 222,817.8 |

|

Microsoft

224,801.0 224,801.0 |

| 10 |

|

Chevron Corporation

211,950.6 211,950.6 |

|

ICBC

211,196.0 211,196.0 |

|

Royal Dutch Shell

222,669.6 222,669.6 |

|

Royal Dutch Shell

222,669.6 222,669.6 |

2011

This

Financial Times Global 500 based list is up to date as of December 31, 2011. Indicated changes in market value are relative to the previous quarter.

| Rank |

First quarter[7] |

Second quarter[8] |

Third quarter[9] |

Fourth quarter[10] |

| 1 |

|

Exxon Mobil

417,166.7 417,166.7 |

|

Exxon Mobil

400,884.5 400,884.5 |

|

Apple Inc.

353,518.1 353,518.1 |

|

Exxon Mobil

406,272.1 406,272.1 |

| 2 |

|

PetroChina

326,199.2 326,199.2 |

|

Apple Inc.

310,412.3 310,412.3 |

|

Exxon Mobil

353,135.2 353,135.2 |

|

Apple Inc.

376,410.6 376,410.6 |

| 3 |

|

Apple Inc.

321,072.1 321,072.1 |

|

PetroChina

303,649.9 303,649.9 |

|

PetroChina

276,473.9 276,473.9 |

|

PetroChina

276,844.9 276,844.9 |

| 4 |

|

Industrial and Commercial Bank of China

251,078.1 251,078.1 |

|

Industrial and Commercial Bank of China

246,850.5 246,850.5 |

|

IBM

208,843.5 208,843.5 |

|

Royal Dutch Shell

236,677.0 236,677.0 |

| 5 |

|

Petrobras

247,417.6 247,417.6 |

|

BHP Billiton

233,626.5 233,626.5 |

|

Microsoft

208,534.9 208,534.9 |

|

Industrial and Commercial Bank of China

228,168.1 228,168.1 |

| 6 |

|

BHP Billiton

247,079.5 247,079.5 |

|

Royal Dutch Shell

225,122.8 225,122.8 |

|

Industrial and Commercial Bank of China

206,021.4 206,021.4 |

|

Microsoft

218,380.1 218,380.1 |

| 7 |

|

China Construction Bank

232,608.6 232,608.6 |

|

Microsoft

219,251.9 219,251.9 |

|

China Mobile

198,778.7 198,778.7 |

|

IBM

216,724.4 216,724.4 |

| 8 |

|

Royal Dutch Shell

226,128.7 226,128.7 |

|

Nestlé

215,017.5 215,017.5 |

|

Royal Dutch Shell

197,061.1 197,061.1 |

|

Chevron Corporation

211,893.9 211,893.9 |

| 9 |

|

Chevron Corporation

215,780.6 215,780.6 |

|

Petrobras

210,111.4 210,111.4 |

|

Nestlé

191,115.6 191,115.6 |

|

Wal-mart

204,659.8 204,659.8 |

| 10 |

|

Microsoft

213,336.4 213,336.4 |

|

IBM

207,781.4 207,781.4 |

|

Chevron Corporation

185,456.1 185,456.1 |

|

China Mobile

196,148.4 196,148.4 |

2010

This

Financial Times Global 500 based list is up to date as of December 31, 2010. Indicated changes in market value are relative to the previous quarter.

| Rank |

First quarter[11] |

Second quarter[12] |

Third quarter[13] |

Fourth quarter[14] |

| 1 |

|

PetroChina

329,259.7 329,259.7 |

|

Exxon Mobil

291,789.1 291,789.1 |

|

Exxon Mobil

314,622.5 314,622.5 |

|

Exxon Mobil

368,711.5 368,711.5 |

| 2 |

|

Exxon Mobil

316,230.8 316,230.8 |

|

PetroChina

268,504.8 268,504.8 |

|

PetroChina

270,889.9 270,889.9 |

|

PetroChina

303,273.6 303,273.6 |

| 3 |

|

Microsoft

256,864.7 256,864.7 |

|

Apple Inc.

228,876.8 228,876.8 |

|

Apple Inc.

259,223.4 259,223.4 |

|

Apple Inc.

295,886.3 295,886.3 |

| 4 |

|

Industrial and Commercial Bank of China

246,419.8 246,419.8 |

|

Industrial and Commercial Bank of China

211,258.7 211,258.7 |

|

Petrobras

220,616.5 220,616.5 |

|

BHP Billiton

243,540.3 243,540.3 |

| 5 |

|

Apple Inc.

213,096.7 213,096.7 |

|

Microsoft

201,655.8 201,655.8 |

|

Industrial and Commercial Bank of China

213,364.1 213,364.1 |

|

Microsoft

238,784.5 238,784.5 |

| 6 |

|

BHP Billiton

209,935.1 209,935.1 |

|

China Mobile

201,471.2 201,471.2 |

|

Microsoft

210,676.4 210,676.4 |

|

Industrial and Commercial Bank of China

233,369.1 233,369.1 |

| 7 |

|

Wal-mart

209,000.7 209,000.7 |

|

Berkshire Hathaway

197,356.8 197,356.8 |

|

China Mobile

205,339.6 205,339.6 |

|

Petrobras

229,066.6 229,066.6 |

| 8 |

|

Berkshire Hathaway

200,620.5 200,620.5 |

|

China Construction Bank

189,170.7 189,170.7 |

|

Berkshire Hathaway

204,792.0 204,792.0 |

|

China Construction Bank

222,245.1 222,245.1 |

| 9 |

|

General Electric

194,246.2 194,246.2 |

|

Signs Maker Inc

178,322.7 178,322.7 |

|

China Construction Bank

202,998.4 202,998.4 |

|

Royal Dutch Shell

208,593.7 208,593.7 |

| 10 |

|

China Mobile

192,998.6 192,998.6 |

|

Procter & Gamble

172,736.5 |

|

BHP Billiton

196,866.0 196,866.0 |

|

Nestlé

203,534.3 203,534.3 |

2009

This

Financial Times Global 500 based list is up to date as of December 31, 2009. Indicated changes in market value are relative to the previous quarter.

| Rank |

First quarter [15] |

Second quarter [16] |

Third quarter [17] |

Fourth quarter [18] |

| 1 |

|

Exxon Mobil

336,525 336,525 |

|

PetroChina

366,662.9 366,662.9 |

|

Exxon Mobil

329,725 329,725 |

|

PetroChina

353,140.1 353,140.1 |

| 2 |

|

PetroChina

287,185 287,185 |

|

Exxon Mobil

341,140.3 341,140.3 |

|

PetroChina

325,097.5 325,097.5 |

|

Exxon Mobil

323,717.1 323,717.1 |

| 3 |

|

Wal-Mart

204,365 204,365 |

|

Industrial and Commercial Bank of China

257,004.4 257,004.4 |

|

Industrial and Commercial Bank of China

237,951.5 237,951.5 |

|

Microsoft

270,635.4 270,635.4 |

| 4 |

|

Industrial and Commercial Bank of China

187,885 187,885 |

|

Microsoft

211,546.2 211,546.2 |

|

Microsoft

229,630.7 229,630.7 |

|

Industrial and Commercial Bank of China

268,956.2 268,956.2 |

| 5 |

|

China Mobile

174,673 174,673 |

|

China Mobile

200,832.4 200,832.4 |

|

HSBC

198,561.1 198,561.1 |

|

Wal-Mart

203,653.6 203,653.6 |

| 6 |

|

Microsoft

163,320 163,320 |

|

Wal-Mart

188,752.0 188,752.0 |

|

China Mobile

195,680.4 195,680.4 |

|

China Construction Bank

201,436.1 201,436.1 |

| 7 |

|

AT&T

148,511 148,511 |

|

China Construction Bank

182,186.7 182,186.7 |

|

Wal-Mart

189,331.6 189,331.6 |

|

BHP Billiton

201,248 201,248 |

| 8 |

|

Johnson & Johnson

145,481 145,481 |

|

Petrobras

165,056.9 165,056.9 |

|

Petrobras

189,027.7 189,027.7 |

|

HSBC

199,254.9 199,254.9 |

| 9 |

|

Royal Dutch Shell

138,999 138,999 |

|

Johnson & Johnson

156,515.9 156,515.9 |

|

China Construction Bank

186,816.7 186,816.7 |

|

Petrobras

199,107.9 199,107.9 |

| 10 |

|

Procter & Gamble

138,013 138,013 |

|

Royal Dutch Shell

156,386.7 156,386.7 |

|

Royal Dutch Shell

175,986.1 175,986.1 |

|

Apple Inc.

189,801.7 189,801.7 |

2008

This

Financial Times Global 500 based list is up to date as of December 31, 2008. Indicated changes in market value are relative to the previous quarter.

| Rank |

First quarter [19] |

Second quarter [20] |

Third quarter [21] |

Fourth quarter [22] |

| 1 |

|

Exxon Mobil

452,505 452,505 |

|

Exxon Mobil

465,652 465,652 |

|

Exxon Mobil

403,366 403,366 |

|

Exxon Mobil

406,067 406,067 |

| 2 |

|

PetroChina

423,996 423,996 |

|

PetroChina

341,140.3 341,140.3 |

|

PetroChina

325,097.5 325,097.5 |

|

PetroChina

259,836 259,836 |

| 3 |

|

General Electric

369,569 369,569 |

|

Industrial and Commercial Bank of China

257,004.4 257,004.4 |

|

Industrial and Commercial Bank of China

237,951.5 237,951.5 |

|

Wal-Mart

219,898 219,898 |

| 4 |

|

Gazprom

299,764 299,764 |

|

Microsoft

211,546.2 211,546.2 |

|

Microsoft

229,630.7 229,630.7 |

|

China Mobile

201,291 201,291 |

| 5 |

|

China Mobile

298,093 298,093 |

|

China Mobile

200,832.4 200,832.4 |

|

HSBC

198,561.1 198,561.1 |

|

Procter & Gamble

184,576 184,576 |

| 6 |

|

Industrial and Commercial Bank of China

277,236 277,236 |

|

Wal-Mart

188,752.0 188,752.0 |

|

China Mobile

195,680.4 195,680.4 |

|

Industrial and Commercial Bank of China

173,930 173,930 |

| 7 |

|

Microsoft

264,132 264,132 |

|

China Construction Bank

182,186.7 182,186.7 |

|

Wal-Mart

189,331.6 189,331.6 |

|

Microsoft

172,929 172,929 |

| 8 |

|

AT&T

231,168 231,168 |

|

Petrobras

165,056.9 165,056.9 |

|

Petrobras

189,027.7 189,027.7 |

|

AT&T

167,950 167,950 |

| 9 |

|

Royal Dutch Shell

220,110 220,110 |

|

Johnson & Johnson

156,515.9 156,515.9 |

|

China Construction Bank

186,816.7 186,816.7 |

|

Johnson & Johnson

166,002 166,002 |

| 10 |

|

Procter & Gamble

215,640 215,640 |

|

Royal Dutch Shell

156,386.7 156,386.7 |

|

Royal Dutch Shell

175,986.1 175,986.1 |

|

General Electric

161,278 161,278 |

2007

Fourth quarter

This

Financial Times based list is up to date as of December 31, 2007.

[23]

1 1 |

Petrochina |

China |

Oil and gas |

723,952 723,952 |

2 2 |

Exxon Mobil |

United States |

Oil and gas |

511,887 511,887 |

3 3 |

General Electric |

United States |

Conglomerate |

374,637 374,637 |

4 4 |

China Mobile |

Hong Kong |

Telecommunications |

354,120 354,120 |

5 5 |

Industrial and Commercial Bank of China |

China |

Banking |

338,989 338,989 |

6 6 |

Microsoft |

United States |

Software industry |

333,054 333,054 |

7 7 |

Gazprom |

Russia |

Oil and gas |

329,591 329,591 |

8 8 |

Royal Dutch Shell |

The Netherlands |

Oil and gas |

269,544 269,544 |

9 9 |

AT&T |

United States |

Telecommunications |

252,051 252,051 |

10 10 |

Sinopec |

China |

Oil and gas |

249,645 249,645 |

Third quarter

This

Financial Times based list is up to date as of September 28, 2007.

[24]

1 1 |

Exxon Mobil |

United States |

Oil and gas |

513,362 513,362 |

2 2 |

General Electric |

United States |

Conglomerate |

424,191 424,191 |

3 3 |

China Mobile |

Hong Kong |

Telecommunications |

327,937 327,937 |

4 4 |

Industrial and Commercial Bank of China |

China |

Banking |

279,269 279,269 |

5 5 |

Microsoft |

United States |

Software industry |

276,202 276,202 |

6 6 |

Royal Dutch Shell |

The Netherlands |

Oil and gas |

264,397 264,397 |

7 7 |

Gazprom |

Russia |

Oil and gas |

260,249 260,249 |

8 8 |

AT&T |

United States |

Telecommunications |

258,047 258,047 |

9 9 |

Citigroup |

United States |

Banking |

232,162 232,162 |

10 10 |

Bank of America |

United States |

Banking |

223,066 223,066 |

Second quarter

This

Financial Times based list is up to date as of June 29, 2007.

[25]

1 1 |

Exxon Mobil |

United States |

Oil and gas |

472,519 472,519 |

2 2 |

General Electric |

United States |

Conglomerate |

393,831 393,831 |

3 3 |

Microsoft |

United States |

Software industry |

281,934 281,934 |

4 4 |

Royal Dutch Shell |

The Netherlands |

Oil and gas |

266,141 266,141 |

5 5 |

AT&T |

United States |

Telecommunications |

255,871 255,871 |

6 6 |

Citigroup |

United States |

Banking |

253,703 253,703 |

7 7 |

Gazprom |

Russia |

Oil and gas |

245,757 245,757 |

8 8 |

BP |

United Kingdom |

Oil and gas |

231,495 231,495 |

9 9 |

Toyota Motor Corporation |

Japan |

Automotive |

228,009 228,009 |

10 10 |

Bank of America |

United States |

Banking |

216,963 216,963 |

First quarter

This

Financial Times based list is up to date as of 30 March 2007.

[26]

1 1 |

Exxon Mobil |

United States |

Oil and gas |

429,567 429,567 |

2 2 |

General Electric |

United States |

Conglomerate |

363,611 363,611 |

3 3 |

Microsoft |

United States |

Software industry |

272,912 272,912 |

4 4 |

Citigroup |

United States |

Banking |

252,857 252,857 |

5 5 |

AT&T |

United States |

Telecommunications |

246,206 246,206 |

6 6 |

Gazprom |

Russia |

Oil and gas |

245,911 245,911 |

7 7 |

Toyota Motor Corporation |

Japan |

Automotive |

230,832 230,832 |

8 8 |

Bank of America |

United States |

Banking |

228,177 228,177 |

9 9 |

Industrial and Commercial Bank of China |

China |

Banking |

224,788 224,788 |

10 10 |

Royal Dutch Shell |

The Netherlands |

Oil and gas |

214,018 214,018 |

2006

Fourth quarter

This Financial Times based list is up to date as of December 2006.

[27]

1 1 |

Exxon Mobil |

United States |

Oil and gas |

446,943 446,943 |

2 2 |

General Electric |

United States |

Conglomerate |

383,564 383,564 |

3 3 |

Microsoft |

United States |

Software industry |

293,537 293,537 |

4 4 |

Citigroup |

United States |

Banking |

273,691 273,691 |

5 5 |

Gazprom |

Russia |

Oil and gas |

271,482 271,482 |

6 6 |

Industrial and Commercial Bank of China |

China |

Banking |

254,592 254,592 |

7 7 |

Toyota Motor Corporation |

Japan |

Automotive |

241,161 241,161 |

8 8 |

Bank of America |

United States |

Banking |

239,758 239,758 |

9 9 |

Royal Dutch Shell |

The Netherlands |

Oil and gas |

225,781 225,781 |

10 10 |

BP |

United Kingdom |

Oil and gas |

218,643 218,643 |

Third quarter

This Financial Times based list is up to date as of 30 September 2006.

[28]

1 1 |

Exxon Mobil |

United States |

Oil and gas |

398,906 398,906 |

2 2 |

General Electric |

United States |

Conglomerate |

364,414 364,414 |

3 3 |

Microsoft |

United States |

Software industry |

272,679.0 272,679.0 |

4 4 |

Gazprom |

Russia |

Oil and gas |

254,634.3 254,634.3 |

5 5 |

Citigroup |

United States |

Banking |

246,727 246,727 |

6 6 |

Bank of America |

United States |

Banking |

242,451 242,451 |

7 7 |

Royal Dutch Shell |

The Netherlands |

Oil and gas |

216,368 216,368 |

8 8 |

BP |

United Kingdom |

Oil and gas |

215,623 215,623 |

9 9 |

HSBC |

United Kingdom |

Banking |

209,774 209,774 |

10 10 |

Pfizer |

United States |

Health care |

206,785 206,785 |

Second quarter

This Financial Times based list is up to date as of 30 June 2006.

[29]

1 1 |

Exxon Mobil |

United States |

Oil and gas |

371,187 371,187 |

2 2 |

General Electric |

United States |

Conglomerate |

342,731 342,731 |

3 3 |

Gazprom |

Russia |

Oil and gas |

246,341 246,341 |

4 4 |

Citigroup |

United States |

Banking |

239,862 239,862 |

5 5 |

Microsoft |

United States |

Software industry |

237,688 237,688 |

6 6 |

BP |

United Kingdom |

Oil and gas |

233,151 233,151 |

7 7 |

Royal Dutch Shell |

The Netherlands |

Oil and gas |

224,925 224,925 |

8 8 |

Bank of America |

United States |

Banking |

219,504 219,504 |

9 9 |

HSBC |

United Kingdom |

Banking |

201,854 201,854 |

10 10 |

Wal-Mart |

United States |

Retail |

200,762 200,762 |

First quarter

This Financial Times based list is up to date as of March 2006.

[30]

1 1 |

Exxon Mobil |

United States |

Oil and gas |

371,631 371,631 |

2 2 |

General Electric |

United States |

Conglomerate |

362,527 362,527 |

3 3 |

Microsoft |

United States |

Software industry |

281,171 281,171 |

4 4 |

Citigroup |

United States |

Banking |

238,935 238,935 |

5 5 |

BP |

United Kingdom |

Oil and gas |

233,260 233,260 |

6 6 |

Bank of America |

United States |

Banking |

211,706 211,706 |

7 7 |

Royal Dutch Shell |

The Netherlands |

Oil and gas |

211,280 211,280 |

8 8 |

Wal-Mart |

United States |

Retail |

196,860 196,860 |

9 9 |

Toyota Motor Corporation |

Japan |

Automotive |

196,731 196,731 |

10 10 |

Gazprom |

Russia |

Oil and gas |

196,339 196,339 |

2005

This Financial Times based list is up to date as of 31 March 2005.

[31]

| 1 |

General Electric |

United States |

Conglomerate |

382,233 |

| 2 |

Exxon Mobil |

United States |

Oil and gas |

380,567 |

| 3 |

Microsoft |

United States |

Software industry |

262,975 |

| 4 |

Citigroup |

United States |

Banking |

234,437 |

| 5 |

BP |

United Kingdom |

Oil and gas |

221,365 |

| 6 |

Wal-Mart |

United States |

Retail |

212,209 |

| 7 |

Royal Dutch Shell |

The Netherlands |

Oil and gas |

210,630 |

| 8 |

Johnson & Johnson |

United States |

Health care |

199,711 |

| 9 |

Pfizer |

United States |

Health care |

195,945 |

| 10 |

Bank of America |

United States |

Banking |

178,765 |

2004

This Financial Times based list is up to date as of 31 March 2004.

[32]

| 1 |

General Electric |

United States |

Conglomerate |

299,336 |

| 2 |

Microsoft |

United States |

Software industry |

271,911 |

| 3 |

Exxon Mobil |

United States |

Oil and gas |

263,940 |

| 4 |

Pfizer |

United States |

Health care |

261,616 |

| 5 |

Citigroup |

United States |

Banking |

259,191 |

| 6 |

Wal-Mart |

United States |

Retail |

258,888 |

| 7 |

American International Group |

United States |

Insurance |

183,696 |

| 8 |

Intel Corporation |

United States |

Computer hardware |

179,996 |

| 9 |

BP |

United Kingdom |

Oil and gas |

174,648 |

| 10 |

HSBC |

United Kingdom |

Banking |

163,574 |

2003

This Financial Times based list is up to date as of 31 March 2003.

[33]

| 1 |

Microsoft |

United States |

Software industry |

264,003 |

| 2 |

General Electric |

United States |

Conglomerate |

259,647 |

| 3 |

Exxon Mobil |

United States |

Oil and gas |

241,037 |

| 4 |

Wal-Mart |

United States |

Retail |

234,399 |

| 5 |

Pfizer |

United States |

Health care |

195,948 |

| 6 |

Citigroup |

United States |

Banking |

183,887 |

| 7 |

Johnson & Johnson |

United States |

Health care |

170,417 |

| 8 |

Royal Dutch Shell |

The Netherlands |

Oil and gas |

149,034 |

| 9 |

BP |

United Kingdom |

Oil and gas |

144,381 |

| 10 |

IBM |

United States |

Computer software, Computer hardware |

139,272 |

2002

This Financial Times based list is up to date as of 31 March 2002.

[34]

| 1 |

General Electric |

United States |

Conglomerate |

372,089 |

| 2 |

Microsoft |

United States |

Software industry |

326,639 |

| 3 |

Exxon Mobil |

United States |

Oil and gas |

299,820 |

| 4 |

Wal-Mart |

United States |

Retail |

273,220 |

| 5 |

Citigroup |

United States |

Banking |

255,299 |

| 6 |

Pfizer |

United States |

Health care |

249,021 |

| 7 |

Intel Corporation |

United States |

Computer hardware |

203,838 |

| 8 |

BP |

United Kingdom |

Oil and gas |

200,794 |

| 9 |

Johnson & Johnson |

United States |

Health care |

197,912 |

| 10 |

Royal Dutch Shell |

The Netherlands |

Oil and gas |

189,913 |

2001

This Financial Times based list is up to date as of 31 March 2001.

[35]

| 1 |

General Electric |

United States |

Conglomerate |

477,406 |

| 2 |

Cisco Systems |

United States |

Networking hardware |

304,699 |

| 3 |

Exxon Mobil |

United States |

Oil and gas |

286,367 |

| 4 |

Pfizer |

United States |

Health care |

263,996 |

| 5 |

Microsoft |

United States |

Software industry |

258,436 |

| 6 |

Wal-Mart |

United States |

Retail |

250,955 |

| 7 |

Citigroup |

United States |

Banking |

250,143 |

| 8 |

Vodafone |

United Kingdom |

Telecommunications |

227,175 |

| 9 |

Intel Corporation |

United States |

Computer hardware |

227,048 |

| 10 |

Royal Dutch Shell |

The Netherlands |

Oil and gas |

206,340 |

2000

This Financial Times based list is up to date as of 31 March 2000.

[36]

| 1 |

Microsoft |

United States |

Software industry |

586,197 |

| 2 |

General Electric |

United States |

Conglomerate |

474,956 |

| 3 |

NTT DoCoMo |

Japan |

Telecommunications |

366,204 |

| 4 |

Cisco Systems |

United States |

Networking hardware |

348,965 |

| 5 |

Wal-Mart |

United States |

Retail |

286,153 |

| 6 |

Intel Corporation |

United States |

Computer hardware |

277,096 |

| 7 |

Nippon Telegraph and Telephone |

Japan |

Telecommunications |

274,905 |

| 8 |

Exxon Mobil |

United States |

Oil and gas |

265,894 |

| 9 |

Lucent Technologies |

United States |

Telecommunications |

237,668 |

| 10 |

Deutsche Telekom |

Germany |

Telecommunications |

209,628 |

1999

This Financial Times based list is up to date as of 30 September 1998.

[37]

| 1 |

Microsoft |

United States |

Software industry |

271,854 |

| 2 |

General Electric |

United States |

Conglomerate |

258,871 |

| 3 |

Exxon Mobil |

United States |

Oil and gas |

172,213 |

| 4 |

Royal Dutch Shell |

The Netherlands |

Oil and gas |

164,157 |

| 5 |

Merck |

United States |

Health care |

154,753 |

| 6 |

Pfizer |

United States |

Health care |

148,074 |

| 7 |

Intel Corporation |

United States |

Computer hardware |

144,060 |

| 8 |

The Coca-Cola Company |

United States |

Beverage |

142,164 |

| 9 |

Wal-Mart |

United States |

Retail |

123,062 |

| 10 |

IBM |

United States |

Software industry, Computer hardware |

121,184 |

1998

This Financial Times based list is up to date as of 30 September 1997.

[38]

| 1 |

General Electric |

United States |

Conglomerate |

222,748 |

| 2 |

Royal Dutch Shell |

The Netherlands |

Oil and gas |

191,002 |

| 3 |

Microsoft |

United States |

Software industry |

159,660 |

| 4 |

Exxon Mobil |

United States |

Oil and gas |

157,970 |

| 5 |

The Coca-Cola Company |

United States |

Beverage |

151,288 |

| 6 |

Intel Corporation |

United States |

Computer hardware |

150,838 |

| 7 |

Nippon Telegraph and Telephone |

Japan |

Telecommunications |

146,139 |

| 8 |

Merck |

United States |

Health care |

120,757 |

| 9 |

Toyota Motor Corporation |

Japan |

Automotive |

116,585 |

| 10 |

Novartis |

Switzerland |

Health care |

104,468 |

1997

This Financial Times based list is up to date as of 30 September 1996.

[39]

Record market capitalizations

On 5 November 2007

A shares of

Petrochina in first day of trading after its

IPO on

Shanghai Stock Exchange

skyrocketed from the IPO price of 16.7 RMB to 43.96 RMB by the close

(opening price was even 48.6 RMB). That gives a market capitalization of

about $1 trillion.

[40] Only 4 billion of A shares were floated during the IPO, another 158 billion of A shares were still held by

China National Petroleum Corporation. 21 billion of

H Shares were already floated on

Hong Kong Stock Exchange.

[41] However market capitalization based on H-shares never reached $500 billion.

[42]

On August 22, 2012

Apple Inc. closed at a record high share price of $668.87.

[43] With 936,596,000 outstanding shares (as of June 30, 2012),

[44] it had a market capitalization of $627.00 billion. The prior record has been held by

Microsoft since December 30, 1999 when it reached an intraday high share price of $119.94.

[45] With 5,160,024,593 outstanding shares (as of November 30, 1999),

[46]

it had a market capitalization of $618.9 billion. Adjusting for

inflation to 2012, Microsoft's market capitalization would be even $846

billion.

[42]

State-owned companies

This

Financial Times Non-Public 150 based list is up to date as of December, 2006. It estimates

Saudi Aramco at 0.781 trillion US$. More recent estimates of 2010 put its value in the range 2.2 trillion USD

[47] to 7 trillion USD.

[48]

| Rank |

2006 [49] |

| 1 |

|

Saudi Aramco

781,000 |

| 2 |

|

Pemex

415,000 |

| 3 |

|

Petróleos de Venezuela

388,000 |

| 4 |

|

Kuwait Petroleum Corporation

378,000 |

| 5 |

|

Petronas

232,000 |

| 6 |

|

Sonatrach

224,000 |

| 7 |

|

National Iranian Oil Company

220,000 |

| 8 |

|

Japan Post (priv. 2007)

156,000 |

| 9 |

|

Pertamina

140,000 |

| 10 |

|

Nigerian National Petroleum Corporation

120,000 |

See also

References

- ^ FT Non-Public 150 - the full list

- ^ "Big Oil, bigger oil". Financial Times. February 4, 2010.

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times Global 500 December 2012

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times

- ^ Financial Times, January 22 1998

- ^ Financial Times, January 1997

- ^ Guardian: PetroChina makes its debut as world's first trillion-dollar firm

- ^ Xinhua: PetroChina opens at 48.6 yuan per share in Shanghai debut, up 191%

- ^ a b AP: Apple market value hits $600B

- ^ http://www.google.com/finance?q=AAPL

- ^ http://files.shareholder.com/downloads/AAPL/1987632841x0x585701/beacb369-cb95-4950-acf4-4fbfa3569ec6/Q3_2012_Form_10-Q_As-Filed_.pdf

- ^ http://www.microsoft.com/investor/reports/ar00/notes-quarterly_information.htm

- ^ http://secfilings.nasdaq.com/filingFrameset.asp?FileName=0001032210%2D01%2D000273%2Etxt&FilePath=%5C2001%5C02%5C14%5C&CoName=MICROSOFT+CORP&FormType=10%2DQ&RcvdDate=2%2F14%2F2001&pdf=

- ^ Sheridan Titman, McCombs School of Business, March 1, 2010. More Thoughts on the Value of Saudi Aramco http://blogs.mccombs.utexas.edu/titman/2010/03/01/more-thoughts-on-the-value-of-saudi-aramco/

- ^ Financial Times, February 4, 2010. Big Oil, bigger oil: http://www.ft.com/cms/s/c5b32636-116f-11df-9195-00144feab49a,_i_email=y,Authorised=false.html?_i_location=http%3A%2F%2Fwww.ft.com%2Fcms%2Fs%2F3%2Fc5b32636-116f-11df-9195-00144feab49a%2C_i_email%3Dy.html&_i_referer=http%3A%2F%2Ftexasenterprise.org%2Farticle%2Fwhats-value-saudi-aramco

- ^ FT Non-Public 150 - the full list

No comments:

Post a Comment