http://www.zentrader.ca/blog/

By All About Trends

Today is the 3rd up day of this run (without counting the reversal day last Friday) all right into a holiday. From here on out we just drift.

Markets are closed tomorrow in the States in observance of Thanksgiving day and are open a half a day on Friday.

IF we do anything on Friday’s abbreviated session it would be all per our game plan of getting rid of long exposure and starting to NIBBLE (think be there trades) on the short side in issues that have that look.

Odds also favor it will be near the open IF we do anything at all. Also odds favor a shortened mid-day update if at all. As far as resistance levels go?

As far as all the talk about WAS that the bottom? We don’t know and nobody else does either. What we do know is that so far it WAS a falling knife low and that is that. See any bottoming pattern? See how all we’ve done is bounce up off the lows within an overall downtrend?

Enough said for now – have a SAFE Holiday!

Game plan for the week

For us the game plan is to play the bounce, get rid of a lot of our longs and re-position on the short side via individual issues and even some Inverse Index ETFs.

The following is a snippet from today’s premium update from All About Trends. Subscribers receive daily commentary and a weekend wrap-up. Experience our accurate market analysis, trading methodology, and stock selection to raise your equity curve for only $20 for the first two months. That is an incredible deal, but before you spend money, give our free newsletter a try to see what we’re all about and grab a free report as well.

Today is the 3rd up day of this run (without counting the reversal day last Friday) all right into a holiday. From here on out we just drift.

Markets are closed tomorrow in the States in observance of Thanksgiving day and are open a half a day on Friday.

IF we do anything on Friday’s abbreviated session it would be all per our game plan of getting rid of long exposure and starting to NIBBLE (think be there trades) on the short side in issues that have that look.

Odds also favor it will be near the open IF we do anything at all. Also odds favor a shortened mid-day update if at all. As far as resistance levels go?

As far as all the talk about WAS that the bottom? We don’t know and nobody else does either. What we do know is that so far it WAS a falling knife low and that is that. See any bottoming pattern? See how all we’ve done is bounce up off the lows within an overall downtrend?

Enough said for now – have a SAFE Holiday!

Game plan for the week

For us the game plan is to play the bounce, get rid of a lot of our longs and re-position on the short side via individual issues and even some Inverse Index ETFs.

The following is a snippet from today’s premium update from All About Trends. Subscribers receive daily commentary and a weekend wrap-up. Experience our accurate market analysis, trading methodology, and stock selection to raise your equity curve for only $20 for the first two months. That is an incredible deal, but before you spend money, give our free newsletter a try to see what we’re all about and grab a free report as well.

20

Nov

The post-election drop in the markets has been swift, but should

be no means a surprise given the series of lower lows and lower highs

on the S&P 500 below. The 2 day rally we’ve seen has been

impressive, but no match for the selling we’ve seen (so far). I rather

expect a dull market throughout the rest of the week and don’t really

see myself taking any trades as I try to avoid choppy, low volume

trading. In other words, now is time to catch up on some reading or

whatever you do when you’re not trading because preserving mental

capital is just as important as preserving your trading account. That

way you’ll be clear, focused, and ready to take advantage of trades when

they do set up.

The VIX is nearing it’s lower wedge pattern and that is not a good set up for the overall markets. One more thrust lower on the VIX and I expect the markets to be under some serious pressure. My dates for this dead cat bounce to end and the primary trend to reassert itself are between the 26th-28th, meaning this week is essentially a write off, as most Thanksgiving weeks are.

The VIX is nearing it’s lower wedge pattern and that is not a good set up for the overall markets. One more thrust lower on the VIX and I expect the markets to be under some serious pressure. My dates for this dead cat bounce to end and the primary trend to reassert itself are between the 26th-28th, meaning this week is essentially a write off, as most Thanksgiving weeks are.

20

Nov

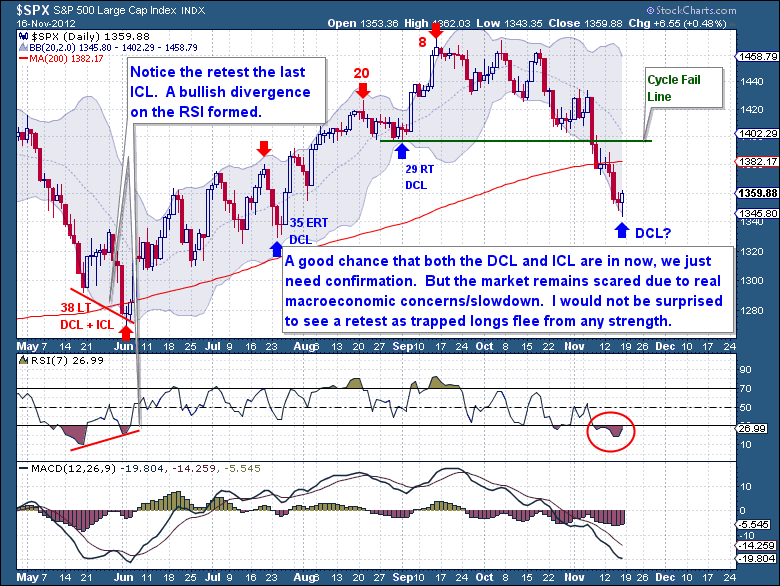

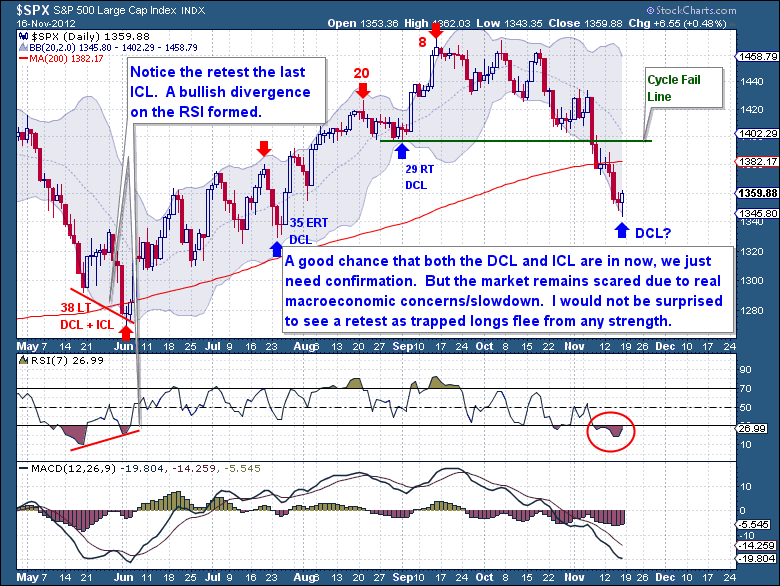

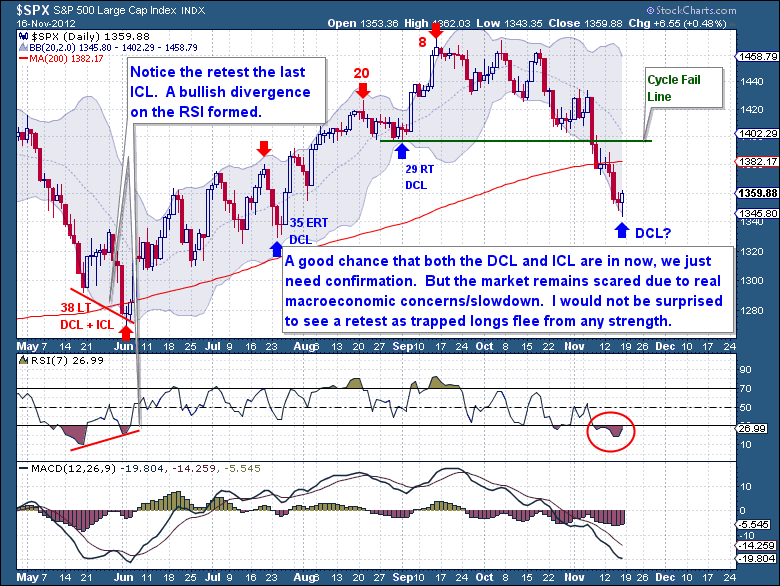

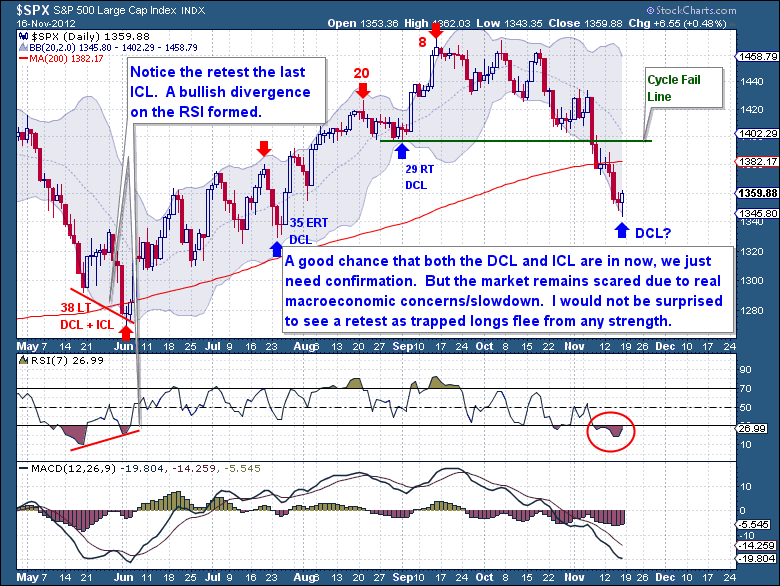

By Poly

The extra downside I spoke of has come and with it the very real possibly of a new Investor Cycle. We never know until a Cycle is confirmed, but the action last week has a really strong chance of having marked a DCL and ICL. We’ve had a number of massive capitulation selling days in this Cycle, but this was the first time it was accompanied by a bullish reversal late in the day. This type of action really does leave the taste of an ICL behind.

Besides the “ICL behavior” witnessed on Friday, the Daily Cycle is really oversold and extremely stretched. I know in trading it can always get worse, but this decline should have run its course now. We should know by early next week if this is a new DCL and ICL as we should expect to see a good follow through rally.

But I am concerned about Equities; you all know that I believe a massive drop into a 4 Year Cycle Low is still ahead of us. To date the natural 4 Year Cycle has remained elevated purely due to the efforts of the Federal Reserve. But it’s more than clear now that the world economy will not hold up despite what the FED does. Europe is now in a confirmed recession; just months after the bureaucrats denied the possibility and were openly talking about new growth. The recession calls in the US too have fallen on deaf ears, only a few are brave enough to call a recession (I called one). Of course confirmation of a recession won’t come for a long time, but the latest slide in Q3 earnings, production, and employment numbers clearly show that we’re dangling on the edge of recession.

This is very important because every 4 Year Cycle has coincided with a recession. Cyclical bull markets end because the underlying fundamentals can no longer support the overly optimistic earnings growth that “analysts” have priced into their models. You see the fundamentals do matter in the long run; they always have and always will. Once the economy cools, earnings begin to come in soft and you go from projecting out future earnings growth to suddenly talking about earnings contraction. This “suddenly” creates a significant gap between estimates and reality. This event is never priced into any of the valuation models and is one of the reasons why the 4 Year Cycle declines are always much more severe than the rally. Recessions “appear” to come quickly and for some reason “surprisingly” to most people.

I don’t know what exactly the VIX is trying to tell us here, but this measure of fear is certainly not lining up with past ICL expectations. Continue reading “VIX Is Displaying Troubling Behavior” »

The extra downside I spoke of has come and with it the very real possibly of a new Investor Cycle. We never know until a Cycle is confirmed, but the action last week has a really strong chance of having marked a DCL and ICL. We’ve had a number of massive capitulation selling days in this Cycle, but this was the first time it was accompanied by a bullish reversal late in the day. This type of action really does leave the taste of an ICL behind.

Besides the “ICL behavior” witnessed on Friday, the Daily Cycle is really oversold and extremely stretched. I know in trading it can always get worse, but this decline should have run its course now. We should know by early next week if this is a new DCL and ICL as we should expect to see a good follow through rally.

But I am concerned about Equities; you all know that I believe a massive drop into a 4 Year Cycle Low is still ahead of us. To date the natural 4 Year Cycle has remained elevated purely due to the efforts of the Federal Reserve. But it’s more than clear now that the world economy will not hold up despite what the FED does. Europe is now in a confirmed recession; just months after the bureaucrats denied the possibility and were openly talking about new growth. The recession calls in the US too have fallen on deaf ears, only a few are brave enough to call a recession (I called one). Of course confirmation of a recession won’t come for a long time, but the latest slide in Q3 earnings, production, and employment numbers clearly show that we’re dangling on the edge of recession.

This is very important because every 4 Year Cycle has coincided with a recession. Cyclical bull markets end because the underlying fundamentals can no longer support the overly optimistic earnings growth that “analysts” have priced into their models. You see the fundamentals do matter in the long run; they always have and always will. Once the economy cools, earnings begin to come in soft and you go from projecting out future earnings growth to suddenly talking about earnings contraction. This “suddenly” creates a significant gap between estimates and reality. This event is never priced into any of the valuation models and is one of the reasons why the 4 Year Cycle declines are always much more severe than the rally. Recessions “appear” to come quickly and for some reason “surprisingly” to most people.

I don’t know what exactly the VIX is trying to tell us here, but this measure of fear is certainly not lining up with past ICL expectations. Continue reading “VIX Is Displaying Troubling Behavior” »

19

Nov

stored in: Technical Analysis and tagged: Market Timing System

By All About Trends

Today is the 3rd up day of this run (without counting the reversal day last Friday) all right into a holiday. From here on out we just drift.

Markets are closed tomorrow in the States in observance of Thanksgiving day and are open a half a day on Friday.

IF we do anything on Friday’s abbreviated session it would be all per our game plan of getting rid of long exposure and starting to NIBBLE (think be there trades) on the short side in issues that have that look.

Odds also favor it will be near the open IF we do anything at all. Also odds favor a shortened mid-day update if at all. As far as resistance levels go?

As far as all the talk about WAS that the bottom? We don’t know and nobody else does either. What we do know is that so far it WAS a falling knife low and that is that. See any bottoming pattern? See how all we’ve done is bounce up off the lows within an overall downtrend?

Enough said for now – have a SAFE Holiday!

Game plan for the week

For us the game plan is to play the bounce, get rid of a lot of our longs and re-position on the short side via individual issues and even some Inverse Index ETFs.

The following is a snippet from today’s premium update from All About Trends. Subscribers receive daily commentary and a weekend wrap-up. Experience our accurate market analysis, trading methodology, and stock selection to raise your equity curve for only $20 for the first two months. That is an incredible deal, but before you spend money, give our free newsletter a try to see what we’re all about and grab a free report as well.

Today is the 3rd up day of this run (without counting the reversal day last Friday) all right into a holiday. From here on out we just drift.

Markets are closed tomorrow in the States in observance of Thanksgiving day and are open a half a day on Friday.

IF we do anything on Friday’s abbreviated session it would be all per our game plan of getting rid of long exposure and starting to NIBBLE (think be there trades) on the short side in issues that have that look.

Odds also favor it will be near the open IF we do anything at all. Also odds favor a shortened mid-day update if at all. As far as resistance levels go?

As far as all the talk about WAS that the bottom? We don’t know and nobody else does either. What we do know is that so far it WAS a falling knife low and that is that. See any bottoming pattern? See how all we’ve done is bounce up off the lows within an overall downtrend?

Enough said for now – have a SAFE Holiday!

Game plan for the week

For us the game plan is to play the bounce, get rid of a lot of our longs and re-position on the short side via individual issues and even some Inverse Index ETFs.

The following is a snippet from today’s premium update from All About Trends. Subscribers receive daily commentary and a weekend wrap-up. Experience our accurate market analysis, trading methodology, and stock selection to raise your equity curve for only $20 for the first two months. That is an incredible deal, but before you spend money, give our free newsletter a try to see what we’re all about and grab a free report as well.

20

Nov

The post-election drop in the markets has been swift, but should

be no means a surprise given the series of lower lows and lower highs

on the S&P 500 below. The 2 day rally we’ve seen has been

impressive, but no match for the selling we’ve seen (so far). I rather

expect a dull market throughout the rest of the week and don’t really

see myself taking any trades as I try to avoid choppy, low volume

trading. In other words, now is time to catch up on some reading or

whatever you do when you’re not trading because preserving mental

capital is just as important as preserving your trading account. That

way you’ll be clear, focused, and ready to take advantage of trades when

they do set up.

The VIX is nearing it’s lower wedge pattern and that is not a good set up for the overall markets. One more thrust lower on the VIX and I expect the markets to be under some serious pressure. My dates for this dead cat bounce to end and the primary trend to reassert itself are between the 26th-28th, meaning this week is essentially a write off, as most Thanksgiving weeks are.

The VIX is nearing it’s lower wedge pattern and that is not a good set up for the overall markets. One more thrust lower on the VIX and I expect the markets to be under some serious pressure. My dates for this dead cat bounce to end and the primary trend to reassert itself are between the 26th-28th, meaning this week is essentially a write off, as most Thanksgiving weeks are.

20

Nov

By Poly

The extra downside I spoke of has come and with it the very real possibly of a new Investor Cycle. We never know until a Cycle is confirmed, but the action last week has a really strong chance of having marked a DCL and ICL. We’ve had a number of massive capitulation selling days in this Cycle, but this was the first time it was accompanied by a bullish reversal late in the day. This type of action really does leave the taste of an ICL behind.

Besides the “ICL behavior” witnessed on Friday, the Daily Cycle is really oversold and extremely stretched. I know in trading it can always get worse, but this decline should have run its course now. We should know by early next week if this is a new DCL and ICL as we should expect to see a good follow through rally.

But I am concerned about Equities; you all know that I believe a massive drop into a 4 Year Cycle Low is still ahead of us. To date the natural 4 Year Cycle has remained elevated purely due to the efforts of the Federal Reserve. But it’s more than clear now that the world economy will not hold up despite what the FED does. Europe is now in a confirmed recession; just months after the bureaucrats denied the possibility and were openly talking about new growth. The recession calls in the US too have fallen on deaf ears, only a few are brave enough to call a recession (I called one). Of course confirmation of a recession won’t come for a long time, but the latest slide in Q3 earnings, production, and employment numbers clearly show that we’re dangling on the edge of recession.

This is very important because every 4 Year Cycle has coincided with a recession. Cyclical bull markets end because the underlying fundamentals can no longer support the overly optimistic earnings growth that “analysts” have priced into their models. You see the fundamentals do matter in the long run; they always have and always will. Once the economy cools, earnings begin to come in soft and you go from projecting out future earnings growth to suddenly talking about earnings contraction. This “suddenly” creates a significant gap between estimates and reality. This event is never priced into any of the valuation models and is one of the reasons why the 4 Year Cycle declines are always much more severe than the rally. Recessions “appear” to come quickly and for some reason “surprisingly” to most people.

I don’t know what exactly the VIX is trying to tell us here, but this measure of fear is certainly not lining up with past ICL expectations. Continue reading “VIX Is Displaying Troubling Behavior” »

The extra downside I spoke of has come and with it the very real possibly of a new Investor Cycle. We never know until a Cycle is confirmed, but the action last week has a really strong chance of having marked a DCL and ICL. We’ve had a number of massive capitulation selling days in this Cycle, but this was the first time it was accompanied by a bullish reversal late in the day. This type of action really does leave the taste of an ICL behind.

Besides the “ICL behavior” witnessed on Friday, the Daily Cycle is really oversold and extremely stretched. I know in trading it can always get worse, but this decline should have run its course now. We should know by early next week if this is a new DCL and ICL as we should expect to see a good follow through rally.

But I am concerned about Equities; you all know that I believe a massive drop into a 4 Year Cycle Low is still ahead of us. To date the natural 4 Year Cycle has remained elevated purely due to the efforts of the Federal Reserve. But it’s more than clear now that the world economy will not hold up despite what the FED does. Europe is now in a confirmed recession; just months after the bureaucrats denied the possibility and were openly talking about new growth. The recession calls in the US too have fallen on deaf ears, only a few are brave enough to call a recession (I called one). Of course confirmation of a recession won’t come for a long time, but the latest slide in Q3 earnings, production, and employment numbers clearly show that we’re dangling on the edge of recession.

This is very important because every 4 Year Cycle has coincided with a recession. Cyclical bull markets end because the underlying fundamentals can no longer support the overly optimistic earnings growth that “analysts” have priced into their models. You see the fundamentals do matter in the long run; they always have and always will. Once the economy cools, earnings begin to come in soft and you go from projecting out future earnings growth to suddenly talking about earnings contraction. This “suddenly” creates a significant gap between estimates and reality. This event is never priced into any of the valuation models and is one of the reasons why the 4 Year Cycle declines are always much more severe than the rally. Recessions “appear” to come quickly and for some reason “surprisingly” to most people.

I don’t know what exactly the VIX is trying to tell us here, but this measure of fear is certainly not lining up with past ICL expectations. Continue reading “VIX Is Displaying Troubling Behavior” »

19

Nov

stored in: Technical Analysis and tagged: Market Timing System

http://www.youtube.com/watch?v=jdKxlgD9g5M&feature=player_embedded#t=299s

No comments:

Post a Comment